Career Oriented Course

Internship Available ✨

India's First Practical Oriented Acounting & Taxation Program

Learn directly from CAs and Industry Expert

Get 100% Placement Assistance

⭐ 4.9/5 Google Reviews

- No. 1 Accounting Course

Online / Offline 3-6 months

Easy EMI Available

100% Job Ready Course

Guaranteed Placement Assistance

- 564+ Already Enrolled

Unlock Multiple Career Options

Get diverse Job Opportunities after completing our Professional Program In Accounting & Taxation

Accounts Manager

Office Admin Executive

Tally Expert/Consultant

Inventory Manager

Financial Analyst

Back Office Executive

Accountant

Tally Freelancer

GST Return Filing Executive

Acquire Today’s Most In-demand Job Skill

Why Accounting with Tally is the Most In-Demand Skill in Today’s Job Market

Every Business’ Requirement

From small startups to huge corporations, every organization needs someone to account for its money

High Job Security

Whether full-time or freelancing, accounting professionals are always in demand with evergreen career opportunities

Suitable for Any Stream

Whether you're in arts, science, or commerce, anyone can land a job as an Accounts Manager, Inventory Manager or Admin Executive and others job in accounting domain

Glimpse of INSKILLS' Powerful Educational Drive

From every corner of West Bengal, we’re shaping futures with expert career guidance and practical learning

India's Premier Accounting Course

This powerful certification course will help you to be proficient with the A to Z accounting concepts, computerized accounting, Tally, MS Office Automation, Google Workspace, etc.

- Certified Faculty

Learn from the certified Domain expert with 8+ years of active teaching experience in this field.

- Online/Offline Classes

Get both online & offline class facilities for deeper learning

- 1:1 Computer Lab Facility

Practice hands-on in a fully equipped, individual lab setup to improve your knowledge.

- Soft Skill Development

Learn real-world accounting along with essential job-ready skills to be fully prepared for today's job market

Course Curriculum

Explore our complete course curriculum, best suited for anyone.

Professional Program in Accounting & Taxation For Entry Level (36 classses - Approx 3 Months)

🏷️ Basics Of Accounts And Inventory ( 10 Classes )

- Fundamentals of Accounting- Meaning of Accounting and phases of accounting cycle, Golden rule, double entry system

- Trial Balance and Financial Statements

- Maintaining Chart of Accounts

- Recording and Maintaining Accounting Transactions

- Fundamental of Inventory Management

- Basic of Supply chain Management

🏷️ Accounts & Inventory Management Through Tally Prime ( 10 classes )

Accounting Through Tally Prime

- Introduction to TallyPrime

- Maintaining Chart of Accounts In Tally Prime

- Recording and Maintaining Accounting Transactions in Tally Prime

- Basics of Banking in Tally Prime

- Generating Financial Statements and MIS Reports

- Data Security in Tally Prime

- Company Data Management in Tally Prime

Maintaining Inventory Through Tally Prime

- Inventory Masters in Tally Prime

- Godown Management

- Inventory report

🏷️ GST ( 10 classes )

- Introduction of Goods and Services Tax

- GST in Tally Prime

- Recording GST compliant transactions

- Accounting Interstate Supply of Goods & Services

- E-Way Bill generation, Update E-way Bill , E-Way Bill Report

- Input Tax Credit Set Off against Liability GST Tax Payment

- Generating GST Returns for Regular Dealer in Tally

🏷️ Basic Office Automation With Microsoft Office ( 6 classes )

Introduction to MS Office

Microsoft Word (Documents)

- Creating, saving, and editing documents

- Formatting text, paragraphs, and pages

- Working with tables, images, and charts

- Headers, footers, and page numbers

- Spell check and grammar tools

- Using templates and styles

Microsoft Excel (Spreadsheets)

- Basic worksheet operations (rows, columns, cells)

- Data entry and formatting

- Basic formulas and functions (SUM, AVERAGE, etc.)

- Charts and data visualization

- Sorting and filtering data

- Introduction to PivotTables

Microsoft PowerPoint (Presentations)

- Creating and designing slides

- Adding text, images, charts, and media

- Slide transitions and animations

- Presentation tips and slideshow mode

- Using templates and themes

Professional Program in Accounting &Taxation For Expert Level (72 Classes - Approx 6 Months)

🏷️ Advance Inventory ( 5 classes )

- Supply chain Management, Inventory Management

- Using of Compound Unit & Alternate Unit for Inventory

- Batch wise Management, Expiry management in Tally Prime,

- Godown transfer, Tracking Movement of goods

- Physical Stock Management, Stock report

- Price Level, Price list Management in Tally prime

🏷️ Accounts Receivable and Payable Management ( 3 classes )

- Outstanding management (Accounts Receivable and payable)

- Specifying of Credit Limit for Parties & Splitting of Credit Sale Into Multiple Bills in Tally Prime

- Enabling Bill-wise practical business scenarios on the given references such as, New Reference, Against Reference, Advance Reference, On account Reference

- Bill Settlement

🏷️ Procurement Process and Sales Order Management ( 4 classes )

- Procurement Process Management

- Procurement Management through tally prime

- Sales Order Processing

- Sales cycle Management in tally Prime

- Report checking

- Godown Management

- Reorder Level

- Project on Purchase and Sales Order Management

🏷️ Tracking Additional Costs of Purchase ( 3 classes )

- Maintain additional costs incurred on purchase of stock.

- Learning Objectives & Introduction to Tracking Additional Costs of Purchase

- Setup Additional Cost in Purchase Transaction in Voucher Mode in Tally Prime

- Purchase Transaction with Additional Cost Details in Item Invoice Mode Debit Note Voucher with Additional Cost

- Purchase Transaction with Additional Cost Details in Item Invoice Mode Debit Note Voucher with Additional Cost

- Report checking

🏷️ Advance GST : Practical GST Accounting with Real-Time Scenarios ( 10 classes )

- Introduction Of GST

- GST Registration , GST Tax structures, Managing HSN & SAC,

- Accounting Intrastate Inward and Outward Supply of Goods & Services,

- Accounting, Sales Return and Purchase Return of Goods under GST

- Hierarchy of Calculating Tax in Transactions, Recording GST compliant transactions

- Recording GST-compliant transactions, Defining GST Rates in different Level

- The procedure of adjusting input credit against liability

- E invoice Basics

- E Way bill Implementation in TallyPrime

- E invoice & E way bill Cancellation from Tally Prime

- E invoice & E way bill Report

- GST Reports

- Generating GSTR-1 and GSTR-3B from Tally Prime for Regular Dealer

- Filing GST Return from Tally Prime

- Explains the composition dealer basic transactions

- Generating GST Returns for Composite Dealer

- Quarterly Return Monthly Payment Scheme (QRMP), Invoice Furnishing Facility (IFF)

- GST Tax Payment (Timeline, Mode of payment, challan Reconciliation)

🏷️ Cost/Profit Centres Management ( 3 classes )

- Allocate expenses and incomes to different cost unit of the organization

- Automation of allocation of cost centre

- cost centre classes in Tally

- Cost centre report

- cost category management

🏷️ Manufacturing Process ( 4 classes )

- Understanding Manufacturing Process

- Concept of Bill of Material (BOM)

- Manufacturing Through Tally Prime

- Create a Bill of Materials (BoM) for Finished Goods

- Stock Report with Finished Goods and Raw Materials

- Finished Goods with Co-product

- Various Reports Regarding Manufacturing

🏷️ Budgets and Scenarios ( 3 classes )

- Maintain Budgets

- Budget report

- Scenario Management

🏷️ Generating and Printing Reports & MIS ( 3 classes )

- Inventory Reports Printing

- Financial Reports Printing

- Print different Registers in Tally

- MIS Report

🏷️ Tax Deducted at Source ( 8 classes )

- Introduction to TDS

- Activate TDS, Creation of TDS Masters and defining TDS at Group and Ledger, Record Basic TDS transactions

- Configuring TDS in Different Level

- Booking of Expenses and Deducting TDS on Multiple Expenses , TDS on Expences on lower or Zero rate, TDS on Expenses on Higher rate

- Expence Partly Subject to TDS , Booking TDS on Expences on crossing the threshold limit, Accounting Multiple Expenses and book TDS on Later,

- TDS payment to government,

- Generating TDS challan

- Generating TDS reports & Mismatch handling

🏷️ Management of Business Data ( 2 classes )

- Exporting Data in Available Formats

- Export import master & Voucher from One company to another company using XML format.

- Print Logo in different vouchers.

🏷️ Moving to the Next Financial Year ( 2 classes )

- Financial period change, Split company

- Creating Group company ,Report checking of different reports

🏷️ Live Session

- GST Filing

- TDS Filing

🏷️ Advance Office Automation With Microsoft Office ( 12 classes )

Microsoft Word Advance

- Introduction of MS word

- Paragraph Formatting Features

- Comments in Word

- Bookmark & Hyperlink

- Understanding Illustration Group

- Page Break and Section Break

- Auto Correct, Find and replace

- Spelling and grammar check

- Tracking Changes

- Watermark, Protect Document

- Practice Exercise

Microsoft Excel Advance

- Introduction to MS Excel

- Inserting and Basic Formatting of Data

- Working with Cell Referencing

- Number and Conditional Formatting

- Working with Formulas (Math , Statistical Functions ,Date and Time Function etc)

- Logical Function (IF Function, Nested IF etc)

- Basics of Financial Function (PMT Function ,PPMT Function ,IPMT Function)

- VLOOKUP and HLOOKUP

Microsoft PowerPoint Advance

- Introduction to PowerPoint

- Creating a New Presentation Applying Theme, Effect, Quick Styles, and Transition Custom Animation, Applying Sound, and Speed Inserting a Picture, Word Art Text, Content Slide Layout, and Background Style

- Creation and Finalization of Presentation using Templates and Slide Master

🏷️ Google Essentials ( 5 classes )

- Google Account

- Gmail

- Google Calendar

- Google Meet for Virtual Communication

- Google Docs, Sheets

🏷️ Personal Development Program ( 5 classes )

- Understanding the Interview Process

- Building Confidence and Self-Awareness

- Mastering Common Interview Questions

- Interview Etiquette and Professionalism

- Mock Interviews and Feedback

Download Our Course Prospectus

30 +

Job Partner

100%

Satisfaction Guarantee

92%

Successful Placement

Why Choose Us?

INVESMATE changing lives with better opportunities

Google Reviews

Social Media Follwers

Successful Students

INVESMATE in the spotlight

Enroll & Secure a 100% Placement Assistance

A Complete 360° Accounting Skill Development Program

A practical, professional-led on-demand accounting program designed for anyone ready to start a career in accounting program .

- Mock Interview Preparation

- Interpersonal Skill Development

- Latest Software

- Expert CA's Guidance

Tally Prime + GST

Learn the fundamentals of accounting with detailed modules on GST Setup & Return Filing, etc.

Office Automation

Learn the useful tools like MS Word, Excel, PowerPoint, etc., for creating engaging presentations.

Google Essentials

Learn to use Google Docs, Sheets, Slides etc., for better work efficiency, collaboration, organization

Why We’re Unique

Standout Features of our Professional Program in Accounting & Taxation

Industry Oriented Curriculum

Not Just Tally! Master 3 in-demand skills in 1 smart program to excel in today's competitive corporate field.

Curriculum Cater for All

We provide complete A to Z modules, which will be perfect for both beginners and professionals.

Flexible Modes of Learning

From online to offline to hybrid formats, we provide versatile learning solutions to fit into today’s busy lives.

Latest version of Software

Learn throughout using the most up-to-date Software version used by Professionals and Business organization

Placement Assistance & Soft-skill Building

Get essential soft skill-building guidance with other mandatory knowledge like Google workspace, interview cracking, etc.

Excellent Assessment + Frequent Tests

Track your progress with our frequent online tests, project assessments, etc., to improve your confidence.

Talk to Our Career Counsellor

Talk to our Career Counsellor, fill the form by clicking on the button to get a call from our CC team

Our Course Pricing Plans

Learn without limits ! Explore our pricing chart and choose your best plan.

Professional Program IN Accounting & Taxation Entry Level

One Time Fees

₹13,999

₹9,999

- Inskill Certificate

- Study Materials

- 100% job Assistance

- Mock Interview

- Online Assessment

- Course Duration 3 Months

25 Seats are Left

Professional Program in Accounting And Taxation Expert Level

One Time Fees

₹29,999

₹24,999

- Inskill Certificate

- Study Materials

- 100% Job Assistance

- Mock Interview

- Online Assessment

- Course Duration 6 Months

15 Seats are Left

Easy EMI Available

Learning shouldn't be a burden on you. So we have an easy EMI facility enabling you to pay the course fees in convenient installments.

100% job assistance

EMI starts from Rs.700

Take Your First Step Towards A Secured Career

Who Is This Course Ideal For?

Freshers

Get 100% job-ready with in-demand knowledge like Tally, accounting, Excel, etc., even if you have no prior experience.

College Students

Build accounting knowledge with Tally software-specific skills alongside your degree to be ahead in today's job market.

Career Switchers

Want to transition from another career segment to accounting or the office admin field with a practical, certification-backed skill set.

Homemaker

Restart your career with the most in-demand skills and make your resume powerful with the latest Tally, GST, etc.

Business Owners

Manage your business accounts, GST, and other essential billing efficiently without relying on others.

Freelancer

Provide accounting-related gigs or services from home virtually to earn extra income at your convenience.

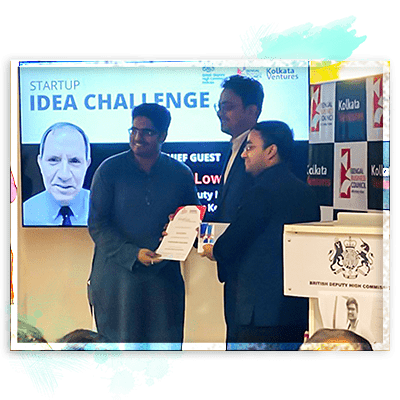

Awards & Recognition

INVESMATE Leading the Financial Education Legacy from the last 6+ years

Students’ Reviews

Read what our students have to say about our course

Do not just dream! Start your Successful Career in Accounting with Us

IPP Expert Panel

Start Your Dream Career with India’s Best Educators

Rohitava Majumdar

NSE Academy’s Certified Capital Market Professional with 10+ Years of Experience

Kunal Saha

NISM Certified Capital Market Professional with 9+ Years of Experience.

Santanu Saha

NISM Certified Professional Value Investor with 9+ Years of practical experience.

Aryama Mukherjee Das

NSE Academy’s Certified Capital Market Professional (NCCMP) 8+ Years of Experience

Debarghya Saha

NISM Certified Capital Market Specialist with 8+ Years of Experience.

Hironmoy Lahiri

NISM Certified Equity Market Specialist with 8+ Years of Experience in the same field.

Get a Sneak Peek

Explore INVESMATE’s Interactive and Engaging Learning Experiences

Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printscrambled it to make a type specimen book.

Frequently Asked Questions!

Here is a list of commonly asked questions that you may have.